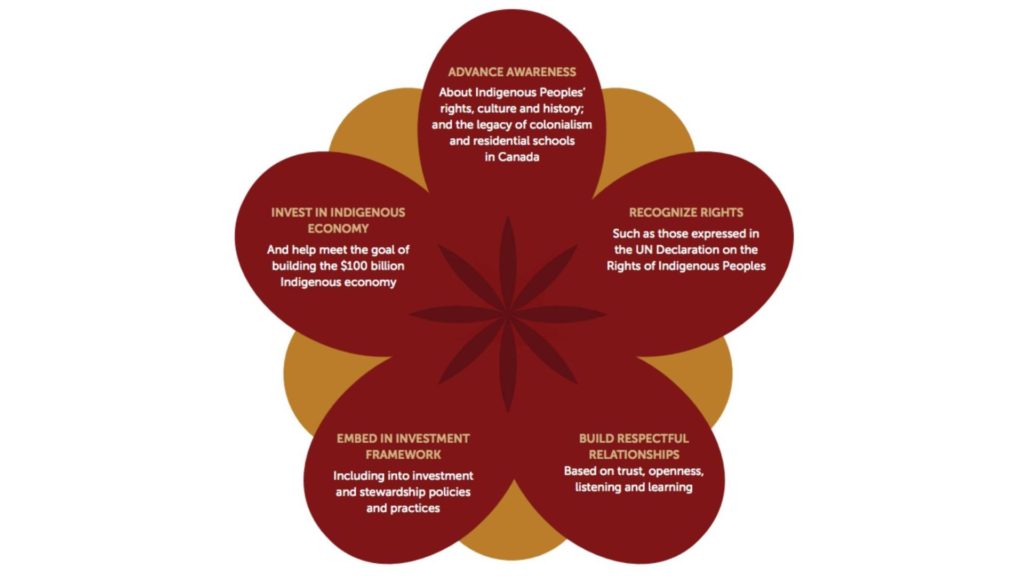

Colette Murphy is the Chief Executive Officer of the Atkinson Foundation. The image above is from the Reconciliation and Responsible Investment Initiative Guidebook, outlining key steps institutional investors can follow to advance reconciliation.

A few years ago, I heard UK-based economist Mariana Mazzucato discuss the concept of economic value, how it has evolved over centuries, and how it reflects the governance of institutions as well as their interactions.

In The Value of Everything: Making and Taking in the Global Economy, Mazzucato asks: What sort of economy do we want? More fulfilling jobs, less pollution, better care, more equal pay? What we value — and who we value — must find its rightful place at the centre of economic thinking, she says.

Fourteen months into this pandemic, I hear these same questions as an urgent call to rewrite Canada’s economic narrative. Who among us will ever see essential workers as a cost on the balance sheet and shareholders as the ultimate risk takers and value creators again? The evolution of value in our economic thinking must include the solidarity that we’ve witnessed over past year, and that the country will need to fully recover in the years ahead. The kind of solidarity that stands against injustice and for our collective health and well-being.

The Reconciliation and Responsible Investment Initiative (RRII) — a collaboration of National Aboriginal Trust Officers Association (NATOA) and the Shareholder Association for Research and Engagement (SHARE) — is one way the Atkinson Foundation is contributing to this evolution. Alongside many Indigenous and non-Indigenous institutional investors, we’re mobilizing capital markets in keeping with Indigenous values and ways of knowing.

Together, we brought forward a bold shareholder proposal on reconciliation and Indigenous inclusion to the TMX Group. The company (which owns the Toronto Stock Exchange) recommended a vote in favour of an amended version. This is the first time a resolution on Indigenous inclusion has ever been jointly endorsed by the board of directors of a Canadian company. It’s a move that is expected to “ripple” through capital markets in North America.

The resolution passed with 98 percent support today at the company’s Annual General Meeting. It obliges the TMX Board of Directors to:

- develop internal programs and policies on equity, diversity, and inclusion (ED&I), including those that encompass current and prospective Indigenous employees, and relationships with Indigenous communities;

- review procurement from Indigenous-owned businesses, and those owned by other underrepresented groups, and establish appropriate disclosure practices and objectives; and

- engage with qualified Indigenous and other organizations to support this work so that these programs can be shown to meet standards that are appropriate for the company and, wherever possible, aligned with commonly-used frameworks and to report in an ongoing way that supports investors’ ability to determine the breadth, depth, and content of these programs.

This is one of many stories that have the potential to transform our thinking about shareholder value and return on investment. A fundamental rewiring of our economy begins with the capacity to imagine alternatives with hope, says Mazzucato. But I say hope alone will not secure the planet or the lives of future generations. Only the active pursuit of justice can do that.

That’s why we’re putting everything we’ve got on the line for a just economy — one that produces lasting value for all of us.